Financial advisors today face a paradox. On one hand, they must honor strict digital privacy laws...

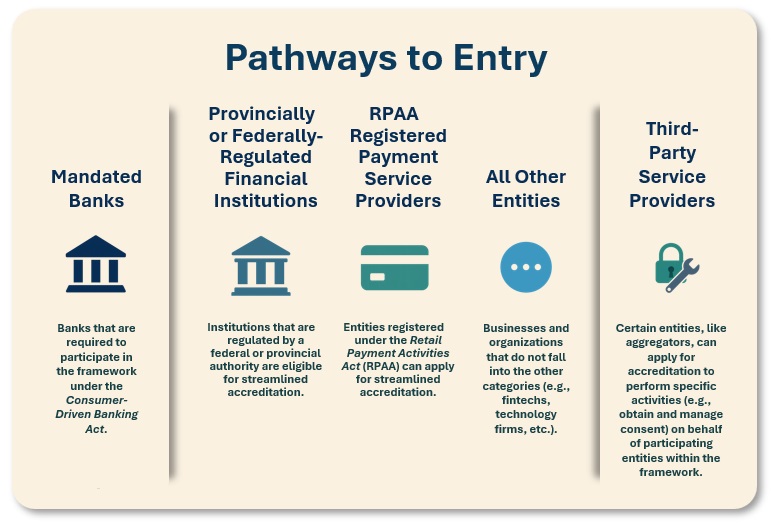

Canada’s 2025 Federal Budget marks the most significant progress yet toward open banking, or, as it’s now formally called, consumer-driven banking. The budget confirms the introduction of legislation to complete the Consumer-Driven Banking Act (CDBA), giving Canadians a legal right to securely share their financial data with accredited third-party providers. At the same time, the government will create a data-mobility right within the Personal Information Protection and Electronic Documents Act (PIPEDA), extending data portability across the entire economy.

Taken together, these changes will allow consumers and businesses to control their financial data while enabling banks, fintechs, and service providers to build secure, interoperable products that drive productivity and competition.

Bank of Canada to oversee the framework

After years of consultation and policy design, the federal government is moving from planning to implementation.

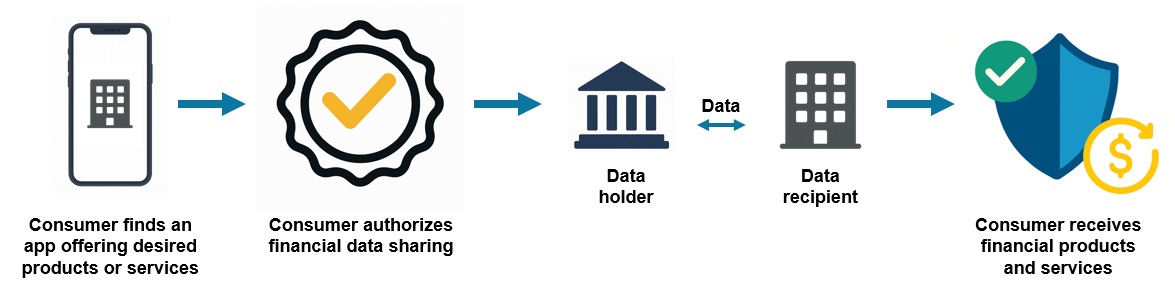

How Consumer-Driven Banking Works

A pivotal change in Budget 2025 is the transfer of open banking oversight to the Bank of Canada. The budget does allocate financing support to this change where the Central Bank will retain $19.3 million over two years to establish supervisory capacity, while the previously allocated $36.9 million for the Financial Consumer Agency of Canada (FCAC) will be reallocated. This decision aligns open banking oversight with the Bank’s existing responsibilities under the Retail Payment Activities Act (RPAA). This new approach seems targeted towards a new regulatory model for payments, financial data, and digital infrastructure. One that emphasizes cybersecurity, resilience, and operational reliability over consumer education alone. To strengthen that framework, the government is investing $25.7 million over five years—plus $5 million ongoing—for the RCMP and CSIS to provide national-security and cyber-risk protection as the system rolls out.

The message is clear: the infrastructure and framework for open banking moving to being treated as core financial infrastructure managed by the Central Bank (just like for payments today), not just a competitive policy initiative.

Real-Time Rail and “write access” coming soon

According to the plans announced so far banking in Canada will unfold in two stages:

-

Read access – secure, consent-based data-sharing between consumers, banks, and accredited providers.

-

Write access – the ability for accredited third parties to initiate transactions such as bill payments, transfers, and account switching.

Timeline of Consumer-Driven Banking

Budget 2025 commits to introducing write access by mid-2027, once Canada’s Real-Time Rail (RTR) payments system is live.

RTR, targeted for launch in 2026, is aimed at enabling 24/7 instant money movement between accounts, eliminating settlement delays and enabling new payment and automation use cases. This integration of open banking with real-time payments will reshape how Canadians move and manage their money securely.

Expanding the regulatory perimeter to digital assets

The 2025 Budget also introduces legislation to regulate fiat-backed stablecoins, ensuring these digital assets are safe and transparent for consumers and businesses. Issuers will be required to maintain sufficient reserves, implement risk-management policies, and protect personal data.

The Bank of Canada will again act as the lead regulator, retaining $10 million over two years to administer the framework. Future amendments to the Retail Payment Activities Act will extend to payment service providers (PSPs) using stablecoins, keeping regulation consistent across all forms of digital payments. Together, these steps modernize Canada’s payments ecosystem, from traditional transfers to tokenized money, within one coherent regulatory structure.

Implications for financial institutions and wealth managers

For Canada’s financial sector, this is a watershed moment. The combination of open banking, real-time payments, and digital-asset regulation will transform how institutions manage data, serve clients, and meet compliance obligations.

Key impacts that we're monitoring include (if everything goes ahead as planned):

-

Data portability as a compliance standard: Institutions must enable secure, consent-based access to client information through APIs.

-

Higher security and technical standards: Oversight under the Bank of Canada will require resilience, encryption, and auditability comparable to payment-system infrastructure.

-

Faster client interactions: With RTR and write access, onboarding, account transfers, and payment workflows will become instant and paperless.

-

Greater innovation: Accredited fintechs will offer new value-added services built on secure, standardized data access.

SideDrawer’s perspective

At SideDrawer, we see these developments as a major leap forward for the financial-services ecosystem. As institutions adopt open-banking infrastructure, the need for secure, compliant, and audit-ready workflow platforms will accelerate.

Our Canadian-hosted, permission-based platform already aligns with the data-sovereignty and security principles underpinning the new framework. For banks, wealth managers, and enterprise advisory firms, SideDrawer provides the secure collaboration layer that supports digital onboarding, document exchange, and compliance. This are exactly the capabilities institutions will need in an open-data environment governed by the Bank of Canada.

What we're watching for next

-

📜 Legislation & accreditation rules – defining who can participate and how liability and consent will work.

-

🔐 Cybersecurity standards – harmonized with payment-system resilience requirements.

-

⚙️ Real-Time Rail integration – connecting data portability to instant payment capabilities.

-

👀 Stablecoin oversight – expanding regulation to digital assets and payment innovation.

-

💡 Data-mobility rollout – extending open-banking principles to other industries.

The bottom line

Budget 2025 turns open banking from a concept into infrastructure. By combining consumer-driven data sharing, real-time payments, and Bank of Canada oversight, Canada is aiming to foster a more secure, modern, and competitive financial ecosystem. Institutions that prepare early, by modernizing data governance and partnering with secure workflow providers, will be the ones best positioned to thrive in this new environment.

About SideDrawer

SideDrawer is a secure, Canadian-based digital-workflow and collaboration platform built for financial institutions, wealth managers, and professional firms. We enable seamless, compliant client engagement through secure data exchange and document management—empowering the next generation of financial-service experiences.

Disclaimer

This article is provided for informational purposes only and reflects interpretations of publicly available materials from Canada’s 2025 Federal Budget and related policy announcements. It is not intended as legal, regulatory, or financial advice. The views expressed are those of the author and do not necessarily represent the official position of SideDrawer Inc. While efforts have been made to ensure accuracy and relevance, SideDrawer Inc. and the author disclaim all liability for any errors, omissions, or outcomes arising from the use of this information. Readers should consult qualified professionals before making decisions based on this content.

.png)