In the modern wealth management landscape, digital empowerment has evolved from an operational...

Wealth-management is riding two unstoppable waves at once: clients’ investable assets are compounding at record speed, while the number of qualified advisers who can steward those assets is barely inching forward. Add fee compression, do-it-yourself trading apps, and a rising expectation that every interaction be as seamless as a food-delivery order, and it’s clear that conventional operating models can’t keep up.

This post unpacks why that capacity crunch is more than a staffing problem—and why the solution starts with a capability that too many “all-in-one” portals still overlook: a secure, API-ready digital vault. If paperwork, fragmented storage or slow onboarding are limiting your growth, read on; the metrics that follow will help you decide whether a digital vault belongs on your tech roadmap.

Wealth is ballooning faster than advisor capacity

Global financial wealth hit $305 trillion in 2024 and, despite recent volatility, BCG projects a ~5-6% compound annual growth rate through 2029. North America already added ~562,000 new millionaires in 2024 and the world’s HNWI population rose 2.6% last year.

Millionaire population growth has been persistent for some time

Millionaire population growth has been persistent for some time

Yet the talent pool and the operational capacity to serve this wealth is not keeping pace:

| Region | Evidence of short-fall | Implication |

|---|---|---|

| United States | McKinsey forecasts a 90 – 110 k advisor gap by 2034; the industry must recruit 30 – 80 k net new advisors vs. 8 k in the previous decade. | Fewer advisors means larger books and rising service-quality risk. |

| Canada | OSC Investor Advisory Panel warns of a “looming shortage” as the average advisor age tops 50 and some channels approach 59. | Succession gaps threaten continuity as retiree cohorts swell. |

| EU / UK | UK adviser head-count jumped 15 % YoY but firm numbers are falling as consolidation bites. | Consumer choice narrows; scale benefits go to consolidators. |

A typical U.S. advisor today handles up to 150 client relationships. If the forecast 100 k advisor shortfall materializes, that average book could swell toward ≈ 210 households per advisor—a 40 % jump—putting significant pressure on adviser service quality unless technology boosts productivity. McKinsey estimates technology and new operating models must unlock 10-20% productivity per advisor just to keep supply and demand in balance.

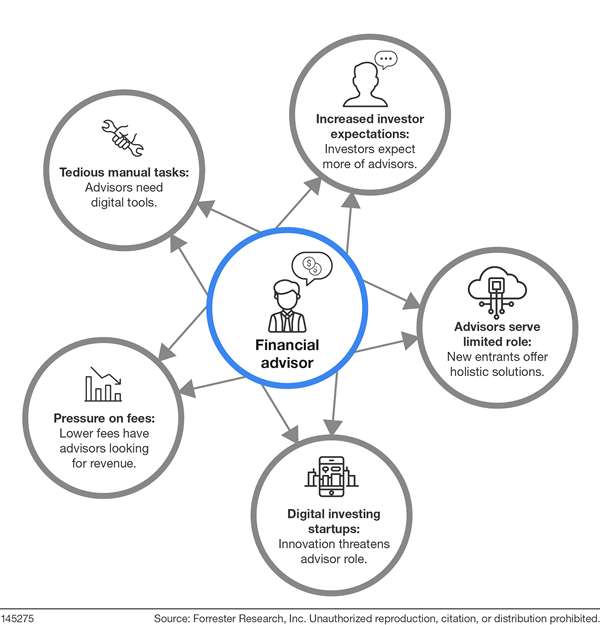

The perfect storm squeezing advisory firms

| Pressure | Signal | What it means |

|---|---|---|

| Fee compression | By 2026, 83 % of U.S. advisors expect to charge < 1 % on $5 m+ accounts; $10 m+ clients already average 66 bps. | Revenue per household is falling while service menus keep expanding. |

| DIY behaviour | 45% of Canadian investors now run a DIY account, many sourcing ideas from social media rather than professionals. | Client loyalty is thinner; advisors must demonstrate value beyond execution. |

| Personalization gap | 65 % of HNWIs say advice is not sufficiently tailored to their needs—an engagement risk. | Generic portfolios risk churn—especially among next-gen heirs. |

| Consolidation & PE capital | In Q1-2025, 87.3 % of RIA deals were PE-backed; median deal size now hovers around $500 m AUM. | Post-deal tech integration delays can erode margins and client experience. |

| Asset complexity | The average UHNWI owns 4.2 homes and allocates more than 20% of investable wealth to commercial property and passion assets like art and wine. | Each asset class spawns extra documents, tax forms, and risk disclosures. |

| Generational wealth transfer | $84 trn will move to heirs by 2045; 81 % of inheritors plan to switch advisors within two years of inheritance. | Massive asset migration risks attrition unless firms offer digital, inter-generational engagement. |

Together these forces ratchet up operational load and regulatory scrutiny precisely when the advisor workforce is projected to shrink by 90 – 110 k in the U.S. alone. Firms that can’t automate low-value tasks and personalize at scale will struggle to defend margins and retain clients.

The rise of robo-advisors – illustrated in Statista’s chart above – captures one of the forces reshaping wealth management: investors are growing comfortable directing money on their own, forcing human advisors to prove differentiated value. Layer that trend, together with Generative AI, onto other market pressures and you get a workload/compliance crunch just as advisor bandwidth tightens.

Why a digital vault is the missing infrastructure

Many firms and technology vendors have implemented digital systems that greatly improve the quality and scalability of their services, including Client Relationship Management, Financial Planning and Investment Management systems. Some providers have even gone so far as to try to create an all-in-one experience that blends together these system categories into one cohesive digital operating model that includes. If you want to learn more about these system options, please check into the post that we did on this element.

The key element that many existing digital portal experiences do not adequately cover is the operational aspect of the financial service. If financial advisors are under fee pressure, they need to scale their businesses to maintain or grow revenues, while improving on their ability to effectively provide an improving service catalogue. They and their teams need to figure out how to provide more value to more people, and the opportunity is there with the growing wealth market! The additional value can come from additional services added to the financial advisor catalogue, for example estate planning, and from more tiered offerings, for example the introduction of a robo-advisory model for mass market clients. The overarching trend that seems very dominant is using technology to personalize services at scale. This may take the form of be new investment services like direct indexing and what it will require is for advisors and client-facing teams to have more capacity.

In larger firms, this used to be accomplished by grouping together specific, non-client-facing work like account opening or regulatory filing into operational centers that would specialize in this work. Smaller firms can still benefit from this, for the efficiency and cost saving benefits, but it does require them to outsource key capabilities to 'platform providers' and that creates risk. The risk of bad client experiences, increased external dependencies and a slower ability to change or adapt operating models to new challenges. What's more, is that it's now clear that we have reached the frontier of efficiency gains from operating model designs and outsourcing alone. We're now at the point where we need to pair these changes with new technologies and the new wave of efficiencies will come from technology-driven operating models.

This is where the digital vault comes into play. The digital vaults gives financial advisors, their operating teams and their clients what they need to decrease the total amount of time that they have to spend on paperwork, and governmental or regulatory forms while also giving advisors key insights on the state of their clients and the people involved on their financial lives.

| Challenge | Vault-enabled benefit |

|---|---|

| Document sprawl across entities & real assets | Single, encrypted repository auto-indexes wills, K-1s, insurance, art appraisals, etc., eliminating “paper-chase” time for staff and clients. |

| Multi-generation planning | Granular permissions let heirs see only what’s relevant, supporting inter-generational governance and the looming $80 tn wealth transfer. |

| Rising service expectations | Concierge teams can fulfil travel, bill-pay, or philanthropic tasks inside the vault workspace, creating white-glove continuity. |

| Reg-tech & AI risk | Immutable audit trails + SOC-2 encryption satisfy KYP/suitability rules and FINRA’s new guidance that Gen-AI output must be fully archived. |

| Fee-vs-value tension | Bundling secure storage, e-sign, policy alerts and AI-generated meeting summaries becomes a visible services stack that defends fees even in a < 1 % world. |

| Cyber-insurance & breach liability | Vault-level encryption, zero-trust access and full audit logs tick the boxes insurers now demand—helping firms avoid the 2-3× premium spike after a data incident. |

It is the missing piece to the digital portal needed to get to the productivity lift that financial advisory teams need to achieve to sustain their asset growth and thrive under these industry pressures. Replacing manual document hunts, approval emails and compliance uploads with a secure vault delivers a meaningful slice of that delta—before you add AI co-pilots on top.

Quantifying the upside

The table that follows isn’t a generic features list—it’s a business-case calculator in miniature. Each row captures an operational bottleneck we see in almost every advisory firm and the per-advisor impact that a digital vault typically unlocks, based on a blend of McKinsey time-motion data and SideDrawer pilot results. It is important to build a set of metrics that capture the current state of your firm and to work with the SideDrawer account team to identify the impact and unit economics that the SideDrawer digital vault can have in your specific practice context. Multiply these unit economics by your own head-count, AUM, and revenue per household to size the upside for your practice. In most cases, the model shows payback in a single quarter and material capacity gains—before you even layer on AI or new service lines.

| Lever | Illustrative impact / adviser | Practice-level impact (10 advisers) |

|---|---|---|

| Automated form completion reminders | 2 – 3 hrs saved per week (~6 % capacity) | +1,300 billable hrs / yr — the equivalent of 1 full-time adviser |

| Document search & classification | 1 hr/week saved | +500 hrs / yr — faster prep, fewer “Where’s that file?” emails |

| Client self-service uploads | 25 % fewer admin emails | 3,000 fewer low-value interactions / yr |

| Clean data room at succession | 10 – 15 % higher client-retention during transitions | On a $1 bn book at 80 bps, that’s $800 k–$1.2 m revenue preserved |

Book your 30 minute consult and book a demo today to start on your tech-powered efficiency journey!

.png)