In today's digital landscape, accountants handle vast amounts of sensitive financial information,...

Financial planners sit at the intersection of paperwork and life‑changing decisions. For every plan recommendation there is a supporting artifact—a signed insurance policy, an executed trade confirmation, a scanned will. Unfortunately those artifacts are often scattered across email threads, desktop folders or client portals that only cover one slice of the planning pie.

SideDrawer solves the fragmentation problem by acting as a secure, API‑driven digital vault that can catalogue every critical document in one place and talk to the systems you already use. Below we map the classic six areas of financial planning to the artifacts advisors must store, outline how SideDrawer organizes them, and highlight complementary platforms that round out the tech stack.

Before we dive into the tech, let’s put some numbers on the table: just how valuable is truly holistic advice?

Why Holistic Planning Matters

Independent studies leave no doubt—coordinated planning isn’t a feel‑good slogan; it can move the return dial by 1½ %‑3 % a year.

-

Up to 3 percentage points of net returns: Vanguard quantifies behavioural coaching, tax‑smart withdrawal and rebalancing as worth "up to, or even exceed, 3%" a year (2022).

-

+1.59 % "Gamma" uplift: Morningstar finds that coordinating withdrawal, asset‑location and annuity strategy can raise retirement spending power by the equivalent of 1.59% alpha.

-

Multi‑dimensional value: Kitces maps tangible ($) and priceless (well‑being) impacts across tax, investment, retirement, risk‑management and behaviour.

The Complete View Of Financial Planning

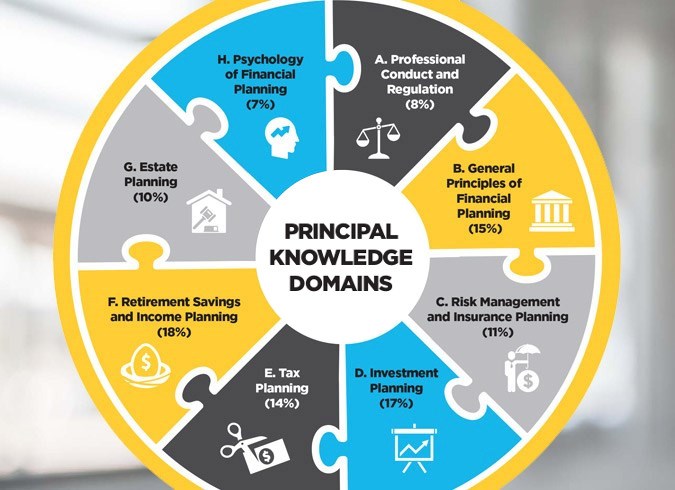

Those gains don’t come from any single tactic; they emerge when all the planning domains click together — exactly what the CFP Board’s puzzle‑wheel visualizes. The CFP Board “Job‑Task Analysis” puzzle‑wheel is the de‑facto industry diagram of comprehensive advice. Its inter‑locking pieces mirror the drawers you can create in SideDrawer, giving readers an instant cognitive map.

There are eight 'principal knowledge domains' mentioned and two of them, 'Professional Conduct and Regulation' and 'Psychology of Financial Planning,' relate more to overall conduct and behaviour in our view. The remaining six inter‑locking domains have artifacts that can gather together for one integrated plan. In SideDrawer, each segment can become a top‑level folder or 'Tile' to help you keep all the key artifacts in order.

The Hidden Cost Of Document Chaos

Fail to keep the artifacts behind those domains in lock‑step, and the economics flip from upside to downside—fast.

| Headline Cost | Evidence | Why It Matters |

|---|---|---|

| 5.3 accounts per consumer across multiple institutions | Mercator Advisory data via PaymentsJournal | More accounts ⇒ more statements, policies and forms to chase. |

| US$79 M in 2023 SEC penalties for poor record‑keeping | Sept 29 2023 SEC press release (sec.gov) | Regulators expect tamper‑proof archiving of all client communications and artifacts. |

| US$4.88 M average breach cost (2024, +10 % YoY) | IBM Cost of a Data Breach 2024 | Unencrypted PDFs in email are liability bombs; zero‑trust vaulting slashes exposure. |

Numbers like those demand a system that turns every pdf, slip and policy into a living asset—not a liability.

Breaking Down Artifacts By Key Areas

So how do you avoid multimillion‑dollar gaps? Start by giving every artifact a permanent, permissioned home. Below is your “manifest”—the critical documents that underpin each planning pillar and exactly where they can live in SideDrawer.

| Key Service Area | Typical Artifacts | Examples Of How SideDrawer Can Help |

| Cash‑flow & Financial Position | • Bank & credit‑card statements • Budget worksheets / cash‑flow reports • Debt amortization schedules |

Create a Cash‑flow drawer with sub‑folders for each account. Use Info Requests or Zapier triggers to pull monthly statements directly into the vault, eliminating insecure email forwarding. |

| Protection / Risk‑Management | • Life, disability & LTC policies • Property & casualty declarations • Group benefits booklets and evidence of insurability |

Store the in‑force contract, the completion certificate, and the annual policy statement in a single record with restricted permissions for the underwriter or MGA. |

| Investment & Portfolio Management | • Investment Policy Statement (IPS) • Quarterly custodial statements • Trade confirms & proxy notices |

Leverage the Addepar integration to drop detailed performance reports straight into the client’s drawer, tagged by quarter. |

| Tax Planning | • Prior‑year tax returns & notices of assessment • Charitable‑receipt PDFs • Realized‑gain & loss reports |

Use Content Packages to auto‑publish annual tax‑slip bundles to every vault on March 1st, and Blast Deliveries for mid‑year CRA/IRS updates. |

| Retirement Savings & Income Planning | • Retirement projections • Pension statements (DB & DC) • RRSP/401(k)/IRA beneficiary forms |

The Planworth integration pipes plan outputs and source data directly into the vault, ensuring assumptions remain linked to the final PDF recommendation. |

| Estate & Legacy Planning | • Last will & testament, powers of attorney • Trust deeds • Shareholders’ agreements & succession plans |

Grant limited collaborator access to executors or trustees. Use DocuSign integration to capture witness signatures, then lock the artifact for tamperproof storage. |

Of course, documents are only as useful as the pipes that deliver them; that’s where integrations earn their keep.

Orchestrating The Whole Stack

With the taxonomy set, the next hurdle is plumbing: ensuring each external system funnels evidence to the right drawer automatically. SideDrawer’s API‑first architecture with over 450 endpoints means every artifact can flow automatically from source system to vault, complete with metadata and role‑based permissions. The result is a single source of truth that satisfies clients, compliance teams and IT security alike. Think of the checklist that follows as a 90‑day sprint to operationalize the architecture you just saw.

Implementation Checklist

-

Define your taxonomy: match each of the six areas to a Drawer type and agree metadata tags.

-

Map data flows: identify which external systems own each artifact and whether you’ll use native integrations, Zapier or custom API calls.

-

Automate ingestion: set up Info Requests, Content Packages and integration webhooks.

-

Educate clients: provide a short loom/video on how to find documents in their vault.

-

Review annually: during plan reviews, audit each drawer for completeness and archive superseded files.

Complete the 90‑day sprint and three compounding benefits kick in immediately

Key Take‑aways

Tick those boxes and three compounding benefits emerge—visibility, efficiency, and risk control.

-

Holistic visibility—Every piece of supporting evidence lives where the plan lives.

-

Operational efficiency—Less swivel‑chair between portals; artifacts arrive pre‑filed.

-

Risk mitigation—Encrypted at rest, permissioned by role, with immutable audit trails.

Ready to turn document chaos into a competitive advantage? Start a 14‑day SideDrawer trial or book a demo—then watch your six‑pillar service model run itself.

.png)